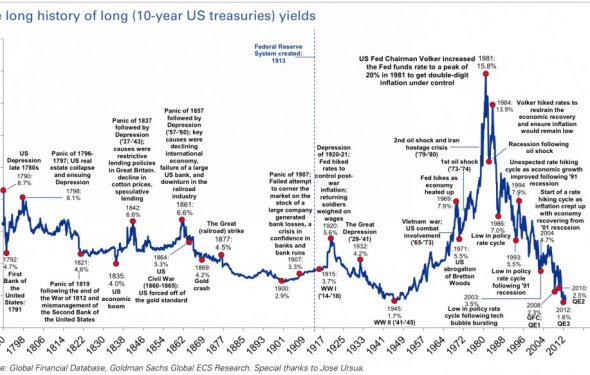

Us treasury bonds historical rates

U.S. sovereign bond prices were lower on Monday as investors focused on a historic deal to cut oil production and eyed a key Federal Reserve meeting on Wednesday.

The yield on the benchmark 10-year Treasury note, which moves inversely to price, was higher at around 2.4831 percent after hitting its highest level since 2014, while the yield on the 30-year Treasury bond was also higher at 3.1748 percent.

The Treasury Department auctioned $20 billion in 10-year notes at a high yield of 2.485 percent.

The bid-to-cover ratio, an indicator of demand, was a light 2.39. Indirect bidders, which include major central banks, were awarded 57.5 percent, below a recent average of 63 percent. Direct bidders, which includes domestic money managers, bought 6 percent, also below a recent average of 9 percent.

Earlier in the day, the Treasury Department auctioned $24 billion in three-year notes at a high yield of 1.452 percent.

The bid-to-cover ratio, an indicator of demand, was 2.65, compared with a recent average of 2.79. Indirect bidders, which include major central banks, were awarded 42.6 percent, below a recent average of 50 percent. Direct bidders, which includes domestic money managers, bought 9 percent, also below a 10 percent recent average.

In oil markets, Brent crude traded at around $56.33 a barrel on Monday, up 3.68 percent, while U.S. crude was around $53.43 a barrel, up 3.69 percent.

OPEC and non-OPEC countries agreed to cut oil production on Saturday and, for the first time in 15 years, a global pact has been secured causing oil prices to rally.

The Federal Reserve Open Market Committee (FOMC) will meet on Wednesday and is widely expected to raise interest rates. According to the CME Group's FedWatch tool, market expectations for a rate hike this week are above 95 percent.

On the data front, Monday will see the Federal budget for November released at 2 p.m. ET. Bond investors will also digest fresh supply in the form of $24 billion in three-year notes and $20 billion in 10-year notes.

resolution resolution antonym resolution and certification of sba resolution and certification resolution agency resolution and independence resolution aaliyah resolution astronomy definition resolution advanced imaging resolution biology definition resolution bioscience resolution bandwidth resolution brewing company resolution bill resolution book resolution biology resolution bong cleaner resolution center paypal resolution center resolution calculator resolution copper resolution center airbnb resolution center ebay resolution chart resolution counseling center resolution definition resolution definition literature resolution definition microscope resolution def resolution definition biology resolution definition in a story resolution drops resolution definition government resolution example resolution economics resolution enhancer resolution english resolution examples in literature resolution ela resolution equation resolution english definition resolution for funeral resolution film resolution formula resolution for printing resolution for 4k resolution fitness resolution for instagram resolution fixer resolution government definition resolution games